california mileage tax bill

The California Department of Transportation is launching four pilot programs in early. But opponents are concerned the legislation is laying.

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg.

. The California legislature passed a bill extending a road usage charge pilot program. Jerry Brown signed into law the first test of mileage-based road taxes in the Golden State. Look up the table with average mileage data for year and make of model maybe adjust for condition and region of the county goose the numbers ten percent and bill accordingly like the auto excise tax.

The San Diego agency expects the state to levy a tax on drivers of roughly 2 cents a mile onto which it would tack a regional 2-cent charge for a. California Expands Road Mileage Tax Pilot Program. Under existing law the purpose of the technical advisory committee is to guide the development and evaluation of a pilot.

California Tests Mileage Fee Plan as Answer to Dwindling Gas Tax. Install a mileage recorder or do like what they do with Kellys Blue Book. Have found Florida to be much.

I have been resisting against all common sense leaving California completely. The bill would require that the pilot program not affect funding levels for a program or purpose supported by state fuel tax and electric vehicle fee revenues. Gavin Newsom signed into law a bill that expands a pilot program that tests whether a tax on miles driven might work better to fund road construction and repair than a tax on fuel purchases.

In 2022 and 2028 a tax of 4 cents per mile and two half cents of local excise tax are planned. As of Aug. If actual mileage is lower get the mileage gismo installed.

Under the new law the group will propose the tax as an alternative to the gas tax and. California is looking at new ways to pay for road and other transportation projects as officials brace for falling gasoline and diesel taxes due to the transition to zero-emission vehicles. But most do have the flexibility to avoid paying Californias 81 cent per gallon listed and hidden gas taxesand any additional mileage tax Sacramento dreams upby driving less.

Instead of paying at the pump when purchasing fuel a mileage tax system determines a drivers vehicle miles traveled with. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. Exploring the state of a motoring California.

Today this mileage tax. Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee. Tags Gas Tax Highway bill Vehicle miles traveled tax Fuel.

In reality the vehicle mileage tax program that is included in the infrastructure bill proposes a three-year pilot program to study the viability of a road user charge. A In 2014 the Legislature passed Senate Bill 1077 Chapter 835 of the Statutes of 2014 which created a Road Usage Charge Technical Advisory Committee to guide the development and evaluation of a pilot program to assess the potential for a mileage-based financing mechanism for Californias roads and highways as an alternative to the gas tax system. California is the second state to test mileage fees in recent years joining Oregon which launched a pilot program of its own in 2014.

The California Road Charge Pilot Program is billed as a way for the state to move from its longstanding pump tax to a system where drivers pay based on their mileage. The 2700 page bill includes a pilot program for vehicle mileage tax to to test the feasibility of a road usage fee. I dont want to sell my home but it is time.

California has announced its intention to overhaul its gas tax system. The program would begin in 2022 and after the three-year period is up it may be voted into law by Congress. Existing law requires the Chair of the California Transportation Commission to create a Road Usage Charge RUC Technical Advisory Committee in consultation with the Secretary of the Transportation Agency.

24 California motorists pay 437 cents per gallon on gasoline taxes. The money so collected is used for the repair and maintenance of roads and highways in the state. Traffic flows past construction work on eastbound Highway 50 in Sacramento California.

Since 2015 the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes. Under the 163 billion plan drivers will be charged a few cents for every mile they drive locally as a way to fund road and transportation improvements. 1077 to establish an advisory committee to study a road usage fee was signed into law by California Governor Jerry Brown.

The bill which passed the state legislature with the backing of transit agencies environmental groups and most major automakers creates a 15-person panel to oversee a pilot of pay-by-the-mile taxation by 2018. The state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under. From SEMA Action Network.

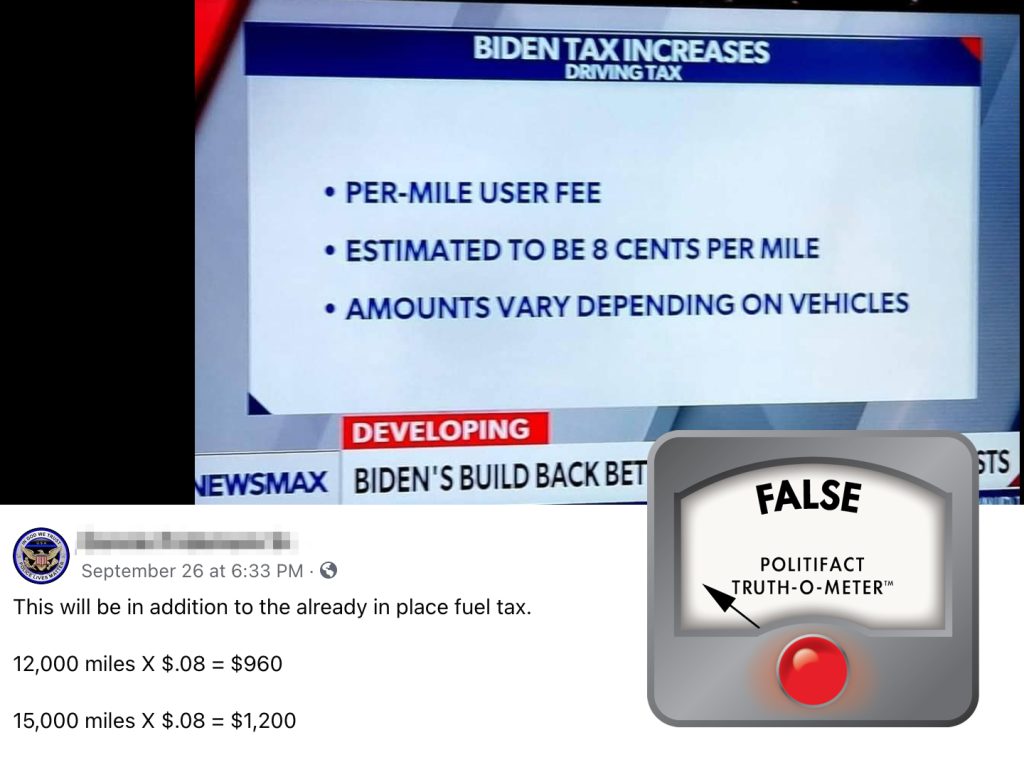

This week President Joe Biden said his 35 billion infrastructure bill will come with absolutely no cost to everyday Americans but inside the bill is a measure to explore a per mile gas tax for anyone who drives a car. Californias annual gas tax collection has fallen since 2006 by 71 percent from 28 billion to 26 billion because the average miles driven by state residents fell by 83 percent from 13300 to. Traditionally states have been levying a gas tax.

The bill would require that participants in the program be charged a mileage-based fee as specified and receive a credit or a refund for fuel taxes or electric vehicle fees as specified. California will be losing another tax payer between all taxes to the statecounty I pay about 12kyear. California Bill to Create Road Usage Fee Pilot Program Signed Into Law.

Californias Proposed Mileage Tax. Mileage-based road usage fee. 36 cents on diesel.

Three weeks ago California Gov. This means that they levy a tax on every gallon of fuel sold.

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

County City Leaders Push Back Against Proposed Mileage Tax

What San Diegans Should Know About The 160b Plan For Transit And Road Charges Approved On Friday The San Diego Union Tribune

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

Secured Property Taxes Treasurer Tax Collector

Mileage Tax Study Not Actual Mileage Tax Proposed In Infrastructure Bill Ap Berkshireeagle Com